Blog

Ethics spat over payday-loan industry in St. Louis takes another change

- 30.11.2020

- Сообщение от: Слинько Инна Сергеевна

- Категория: cheap payday loans

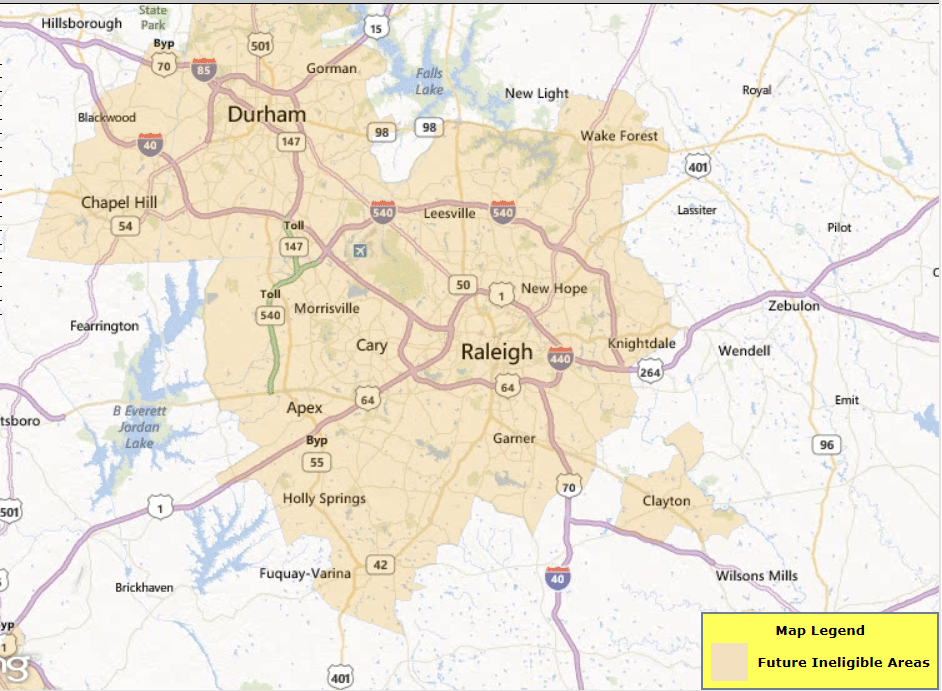

Payday outlets that are lending the St. Louis area are generally focused in low-income areas.

About ten years ago, Lavern Robinson got swept up into the payday-loan squeeze.

Whenever bills are turning up and there’s no location to turn, the fast solution of money from the payday lender can look like a idea that is good. Like to save your valuable car, feed your kids or make that homeloan payment? That part shop guaranteeing quick money issues its siren call.

In Missouri, however, one pay day loan is rarely sufficient. Rates of interest are incredibly astronomical — they average significantly more than 450— that is percent to create payment close to impossible. One loan contributes to two, or three, or, in Robinson’s instance, 13 loans that are separate.

Thinking that she was indeed taken advantageous asset of by a operational system that preys in the desperation for the bad, Robinson discovered legal counsel and took Title Lenders Inc., also called Missouri payday advances, to court. A judge took pity on her.

He unearthed that the agreements Robinson finalized to have her money — which severely limited her prospective legal redress — were “unconscionable.”

Title Lenders Inc. lawyered up and appealed the instance most of the method to the Missouri Supreme Court. The state’s top court overturned the circuit court decision that had been in Robinson’s favor in 2012, after the U.S. Supreme Court had issued a favorable ruling regarding arbitration contracts such as the ones used by payday-loan companies.

One of the solicitors whom won the full situation for Title Lenders Inc.?

Four years later, the lawyer who had been when the chief of staff to former Gov. Bob Holden seems to be doing the putting in a bid of this payday-loan industry once again. Early in the day this present year, she filed an ethics issue with the Missouri Ethics Commission against St. Louis Alderman Cara Spencer, twentieth Ward, after Spencer filed two board bills focusing on the payday-loan industry.

Dueker argued that Spencer, that is the executive manager associated with the nonprofit customers Council of Missouri, had neglected to register a page outlining a possible conflict of great interest because  her manager advocates up against the payday-loan industry with respect to customers.

her manager advocates up against the payday-loan industry with respect to customers.

The Missouri Ethics Commission dismissed the grievance in October, discovering that Spencer would derive no benefit that is financial the legislation. The main facet of the two bills had been an endeavor to need payday loan providers to pay for a $10,000 license to accomplish business within the town, also to require more strict warnings in regards to the nature of high interest levels.

“There is not any proof that your particular work, pay, or other advantage you might presently are based on your manager could be influenced by the passage through of either Board Bill 69 or 70,” the ethics payment published. “Therefore, you’ve got no responsibility to register a pursuit declaration because of the City Clerk as alleged within the issue.”

If the dispute arose, Dueker decided to go to great pains to split by herself through the payday-loan industry. She stated she wasn’t working that she had never — ever — derived any financial benefit from the payday-loan industry for them, and, in fact, told reporters and others.

In a few tweets protecting her problem, Dueker’s language could n’t have been more clear:

“I have not gotten one dime from predatory lenders,” she penned on Twitter in October, following the problem against Spencer was in fact dismissed.

Earlier in the day, on Sept. 30, she ended up being a lot more definitive:

“I haven’t now nor ever been compensated or hired by spend day loan industry. I believe alderman should disclose disputes. Ald Spencer declined.”

I’ve maybe perhaps not now nor ever been compensated or hired by pay day loan industry, i do believe alderman should disclose disputes. Ald Spencer declined.

In reality, Spencer disclosed her conflict that is potential multiple. Like other elected officials, she files your own disclosure that is financial outlines her work. She talked about the board bills and any conflict that is potential Tim O’Connell, the lawyer when it comes to Board of Aldermen, before filing any legislation. She talked about her work freely in concerns off their aldermen.

“I observed the guidance for the counsel associated with the board,” she said.

So just why did Dueker claim she had no link with the payday-loan industry whenever merely a years that are few she had won an incident on the part of payday loan providers ahead of the Missouri Supreme Court?